Thane has been one of the most sought real estate investment destinations in India over the last few years. The demand for residential and commercial

property in Thane has been increasing, due to the great investment potential in this region. Besides, the demand for elegant properties in all other cities in India has been increasing. Real estate happens to be one of the most acknowledged sectors globally. It consists of four sub-sectors these include retail, housing, commercial and hospitality. In Thane, all these sub-sectors have experienced a surge in demand. Besides, the demand for sophisticated commercial and office spaces has increased over the years in Thane.

Business investors are looking for accommodations in both urban and semi-urban regions. With the construction industry ranking 3rd among the fourteen prime sectors in the economy, the real estate industry in 2020 looks progressive in India.

In the coming years, a greater number of NRI residents would be looking forward to buying residential and commercial property. Already, in the last few years, several NRI investments have set up a fresh trend in the major Indian cities. Thane is among the top investment hubs for NRIs. However, cities like Bangalore, Chennai, Ahmedabad, Goa, Delhi, Pune and Dehradun are also following close behind.

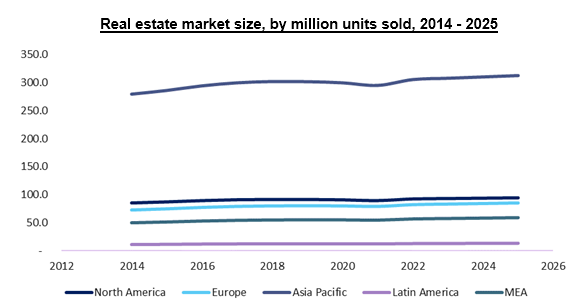

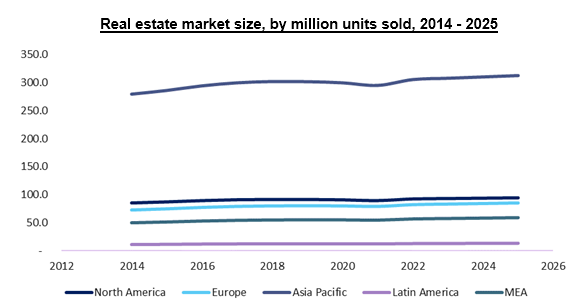

Real estate market size

The real estate industry has gone through several changes, with reforms and new norms coming up. The market size is likely to increase significantly in 2020. By 2030, the market size is likely to reach $ 1 trillion. In 2017, the real estate market stood at $ 120 billion. With this growth, the sector is likely to contribute to 13% of the GDP of the country by 2025. Apart from residential real estate, the demand for retail, commercial and hospitality segments is also increasing. Particularly, property in Thane is in high demand, due to the proximity to Mumbai. The city has got good infrastructure and connectivity, which ensures that the residents can connect to important places seamlessly.

|

| Source by google |

|

Demand for commercial real estate

In recent years, the demand for office and retail spaces has increased significantly among the eCommerce and consulting companies. The IT sector and ITeS continue to fuel the demand for classy commercial spaces in the key cities of India. In the top eight Indian cities, leasing of office space is likely to exceed 100 million Sq.Ft. between 2018 and 2020.

In the first three quarters of 2018, the absorption of office space in the key cities in India had witnessed a significant increment. Although the growth slowed down to a certain extent due to various factors, the industry is likely to enjoy healthy growth in 2020. Eventually, the demand for

property in Mumbai would be on the rise.

Initiatives are taken by the government

The initiatives that the government has taken in the last few years to strengthen the real estate sector has been instrumental in fostering the healthy growth of this sector. Particularly, the Smart Cities are coming up in as many as 100 locations in India. Real estate companies are enjoying a prime opportunity to launch new projects, that live up to the demands of the residents. Besides, the inception of

RERA and the implementation of GST on real estate have further enhanced transparency in the real estate sector in India.

Here are some details you would be interested in:

- The government has sanctioned more than 8.09 million homes under the PMAY (Pradhan Mantri Awas Yojana) till May 2019.

- The National Urban Housing Fund was created in February 2018. The body approved an outlay of INR 60,000 crore, equivalent to $9.27 billion.

- During 2017-2018, 1,427,486 urban homes had been sanctioned under the Pradhan Mantri Awas Yojana (PMAY). This figure is likely to increase in 2020.

What to expect in 2020?

In 2020, the investment in the real estate sector would be increased significantly, given that the industry now enjoys greater transparency. Therefore, the demand for

Mumbai property and other prime cities would also rise. The SEBI (

Securities and Exchange Board of India) has already approved the REIT (Real Estate Investment Trust) platform.

Evidently, investors in the real estate sector would be enjoying good returns from the market. Over the next few years, it is estimated that the REITs would create an opportunity worth INR 1.25 trillion ($19.65 billion) in the real estate sector in India.

Considering the increasing demand of the homeowners, and globalization in real estate investment, the sector is likely to further benefit. The developers need to address the fresh challenges that come across the way. Presently, the reputed real estate groups are working on multiple projects in various cities. Besides, they need to cater to the needs of luxury home buyers as well as

affordable home investors. With the real estate industry gaining momentum, the sector is likely to strengthen in 2020.

Comments